Case Study

Case Study

Case Study

Faster Onboarding, Fewer Support Touchpoints

Faster Onboarding, Fewer Support Touchpoints

An Endless PDF and Painful Phone Calls

An Endless PDF and Painful Phone Calls

Before the redesign, merchants had to complete one long, confusing PDF doc on their own. Most couldn’t understand the questions without customer support walking them through every step. This created:

Long onboarding times

Frustrated merchants

Heavy reliance on support reps

Dependence on third-party tools for verification

What should have been a fast, self-serve onboarding experience, had become a barrier.

Before the redesign, merchants had to complete one long, confusing PDF document on their own. Most couldn’t understand the questions without customer support walking them through every step. This created:

Long onboarding times

Frustrated merchants

Heavy reliance on support reps

Dependence on third-party tools for verification

What should have been a fast, self-serve onboarding experience, had become a barrier.

Snapshot

1 Lead Designer

1 Product Manager

6 Software Engineers

Design Outcomes

Replaced PDF with a 5-step guided flow

Added plain-language tooltips, progress indicators, and stacked fields for accessibility

Enabled collaborative submissions (invite colleagues)

Built in flexible document handling and transparent confirmations

Customer Outcomes

Independent, faster onboarding with less frustration

Clear context built trust and confidence

Accessible, transparent, and collaborative experience

Business Outcomes

80% successfully completing application on first pass

70% require no follow-up for KYC/KYB (Know Your Customer Know Your Business)

70% onboarded within 48 hours

Cleaner submissions reduced underwriting rework

First in-house onboarding system, cutting third-party reliance

Financial Outcomes

Lower support costs and faster merchant activation

Improved time-to-revenue and compliance confidence

Scalable system supporting growth without extra headcount

Snapshot

1 Lead Designer

1 Product Manager

6 Software Engineers

Design Outcomes

Replaced PDF document with a 5-step guided flow

Added plain-language tooltips, progress indicators, and stacked fields for accessibility

Enabled collaborative submissions (invite colleagues)

Built in flexible document handling and transparent confirmations

Customer Outcomes

Independent, faster onboarding with less frustration

Clear context built trust and confidence

Accessible, transparent, and collaborative experience

Business Outcomes

80% successfully completing application on first pass

70% require no follow-up for KYC/KYB (Know Your Customer Know Your Business)

70% onboarded within 48 hours

Cleaner submissions reduced underwriting rework

First in-house onboarding system, cutting third-party reliance

Financial Outcomes

Lower support costs and faster merchant activation

Improved time-to-revenue and compliance confidence

Scalable system supporting growth without extra headcount

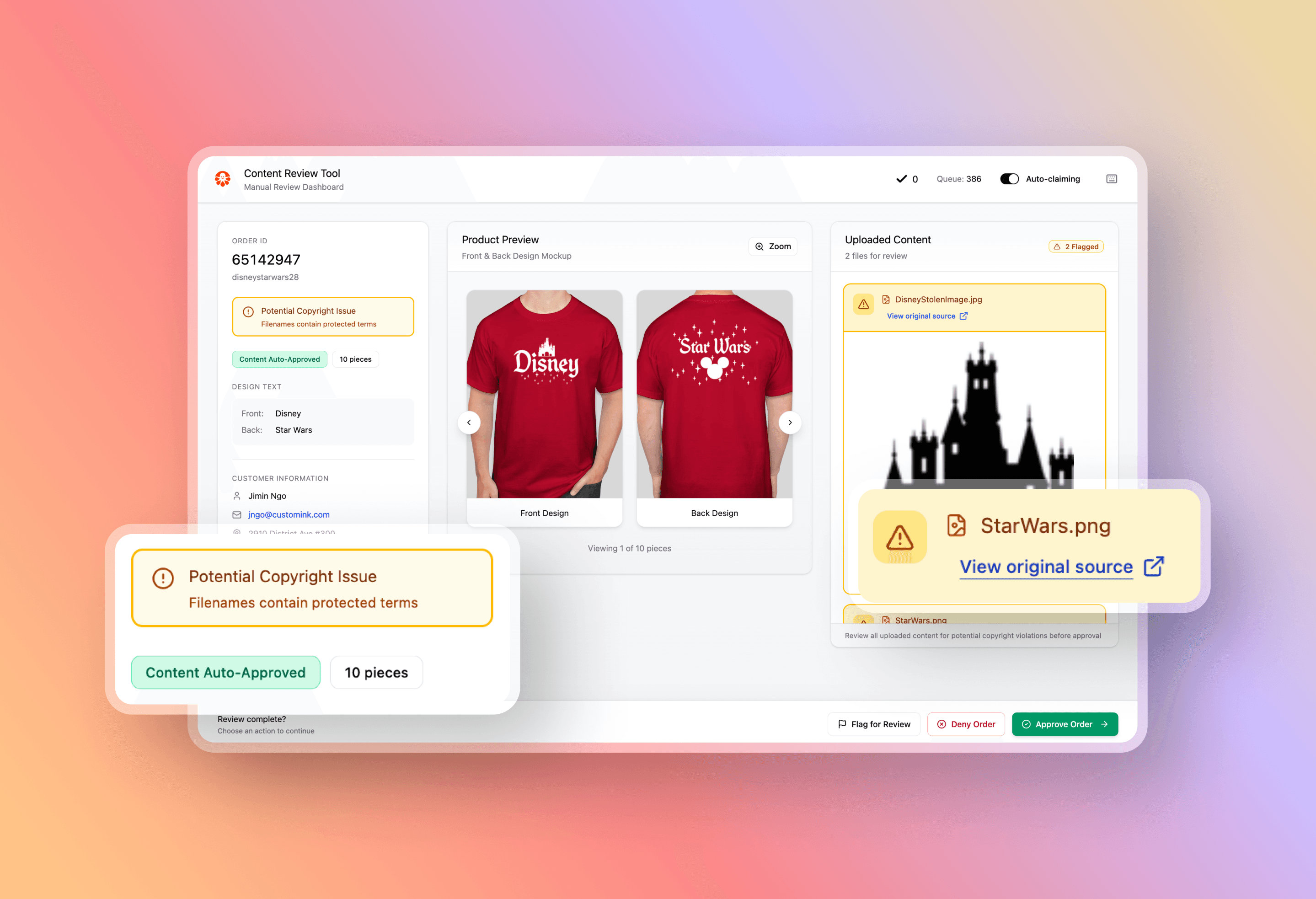

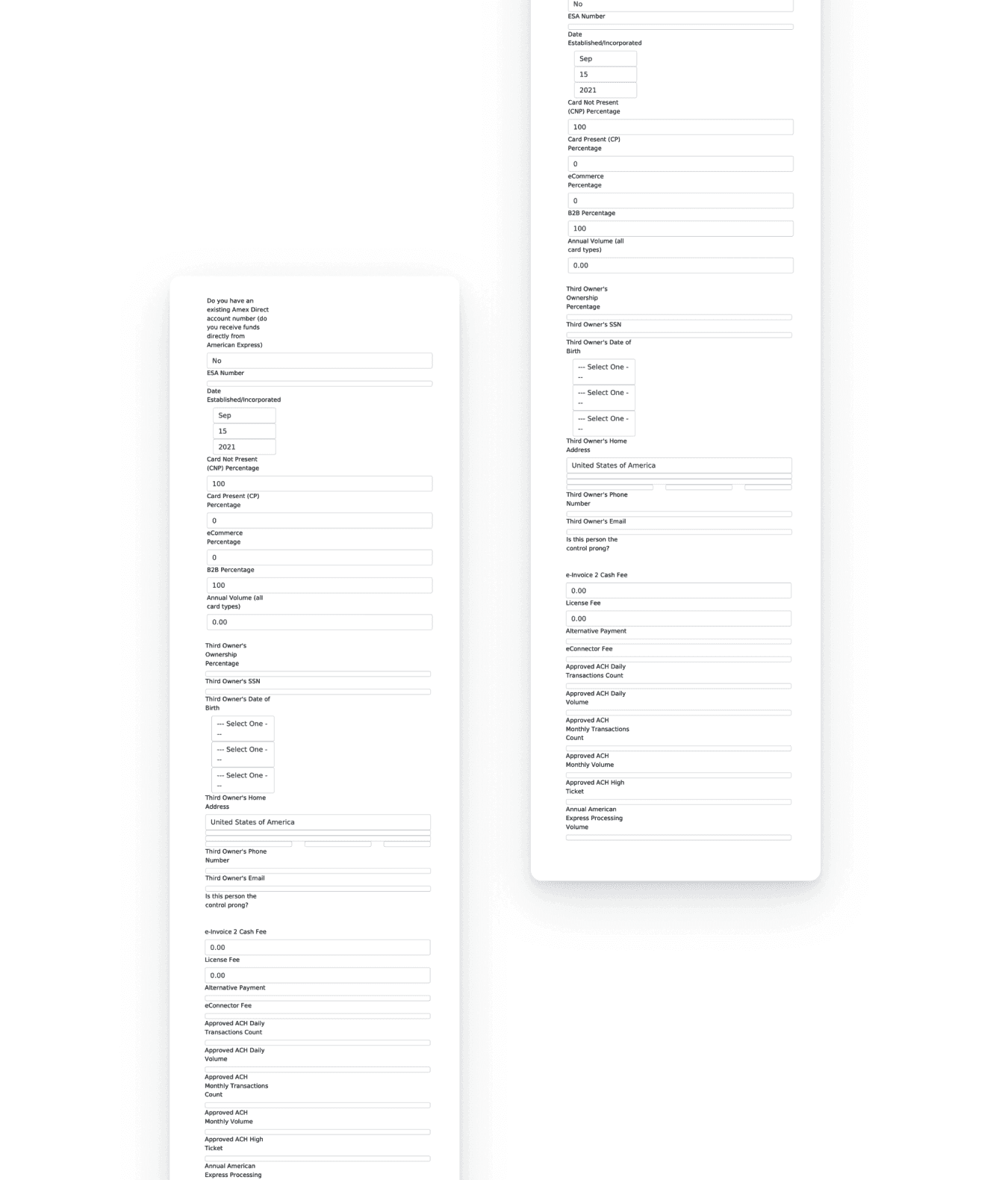

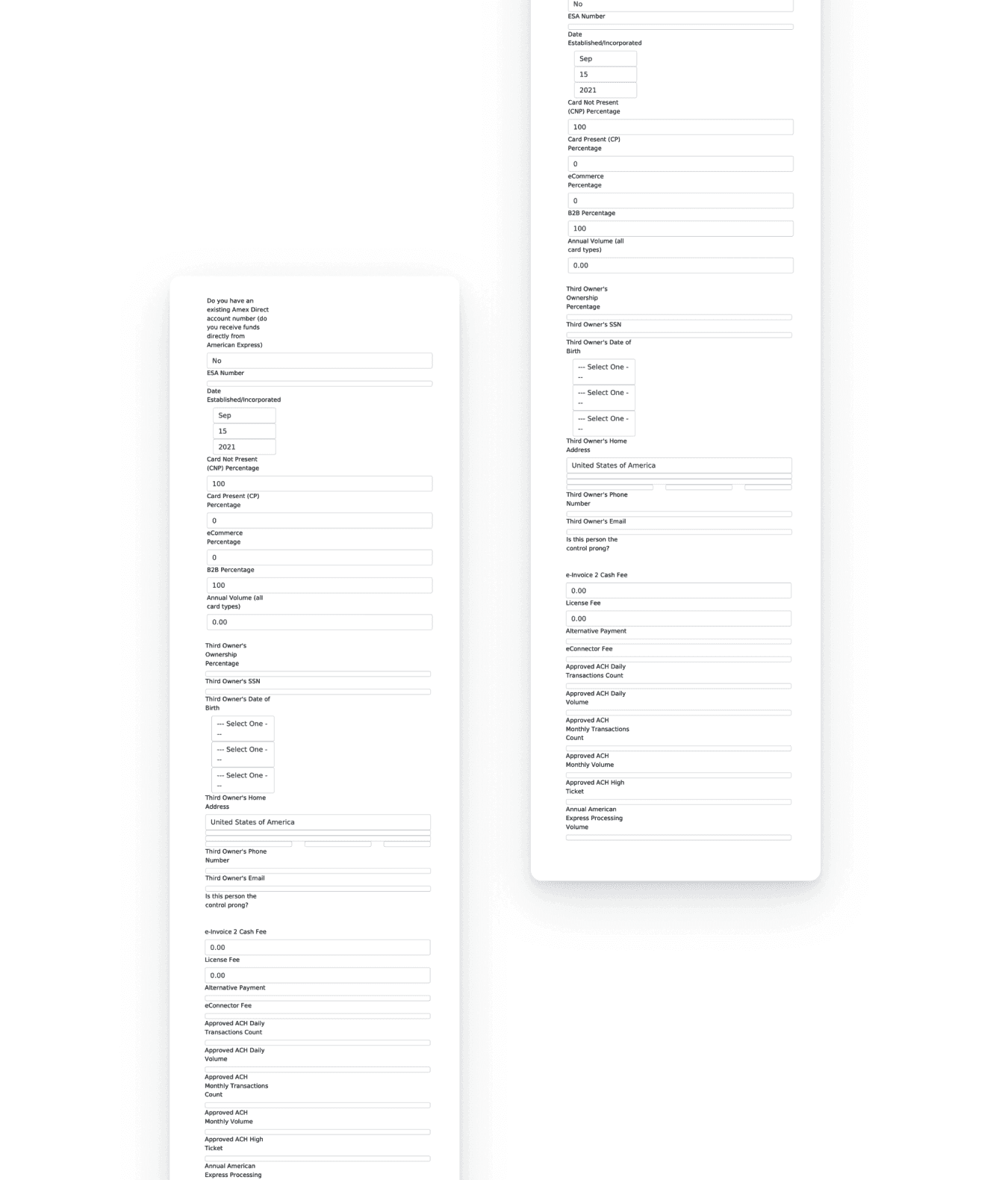

Before 👎

Before 👎

Merchants faced a long, confusing PDF document and relied on support to walk them through the application on the phone.

Merchants faced a long, confusing PDF document and relied on support to walk them through the application on the phone.

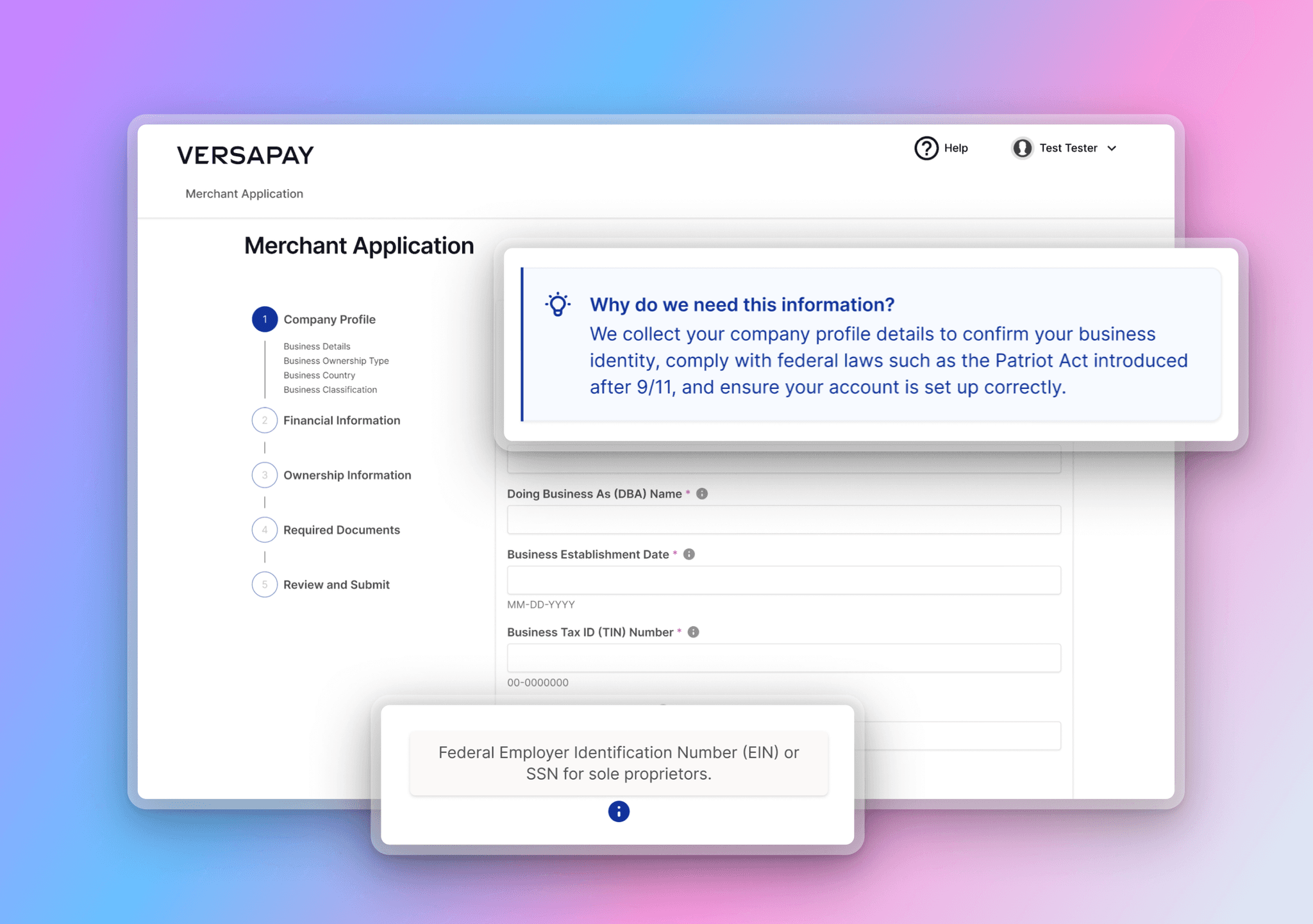

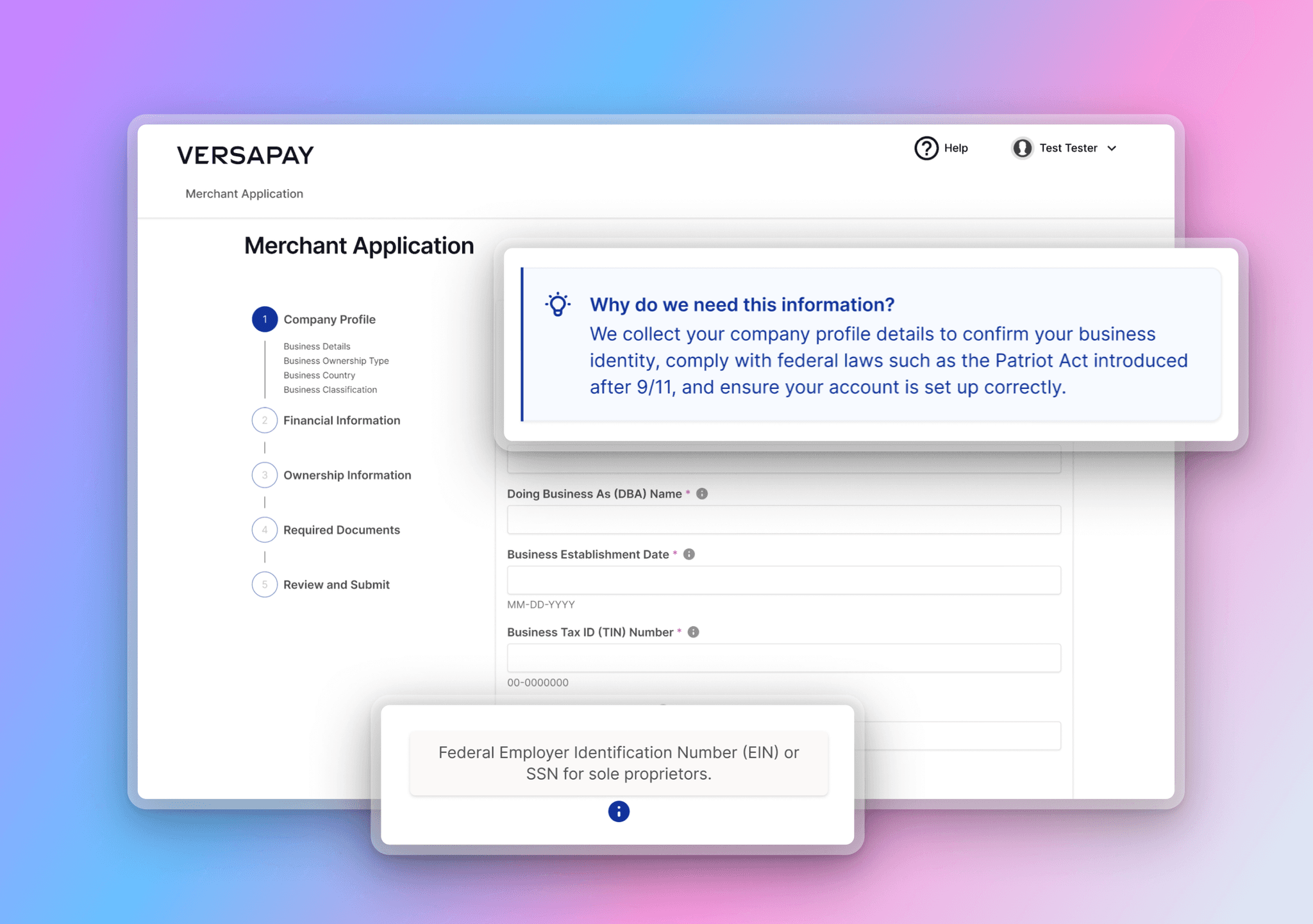

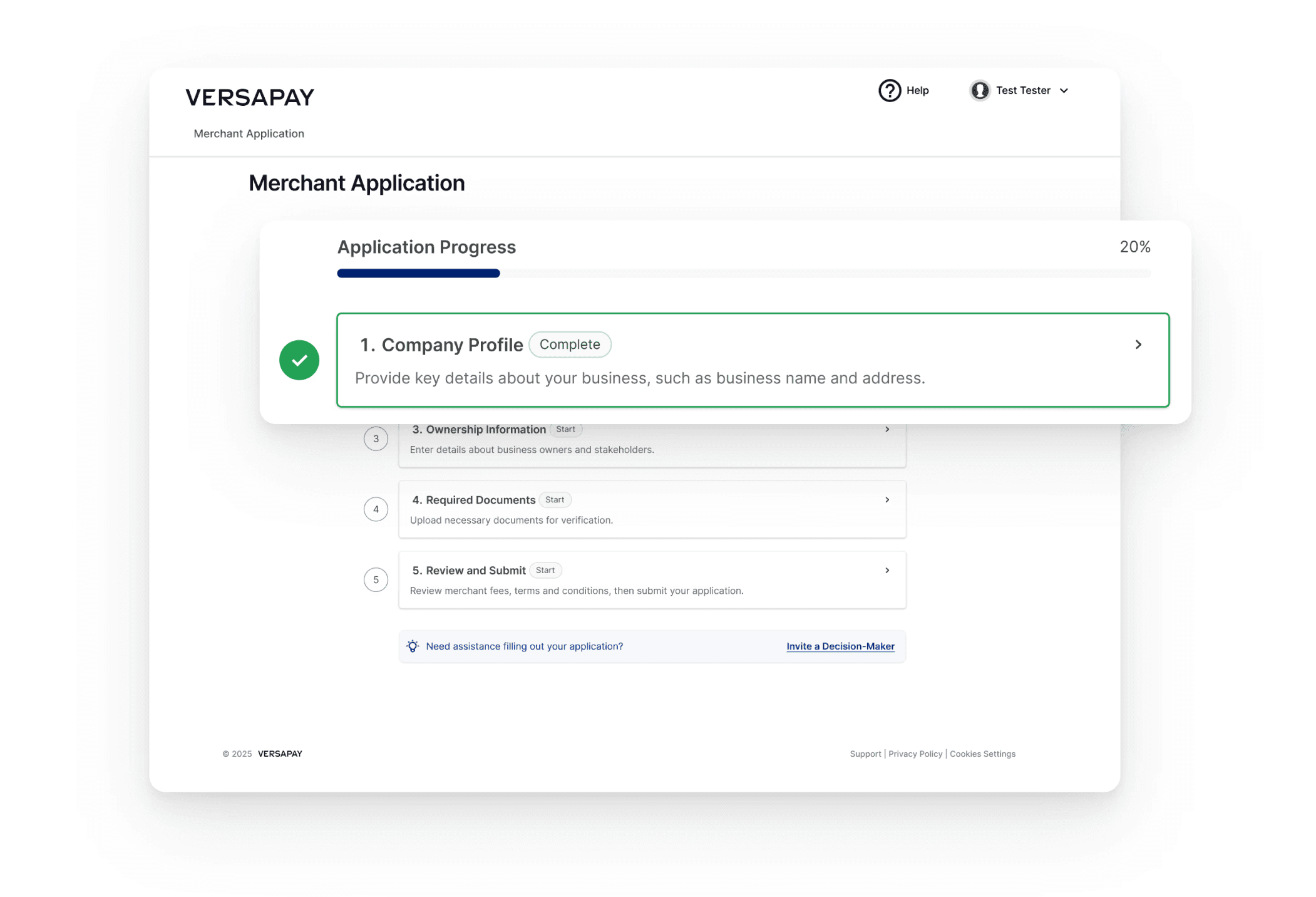

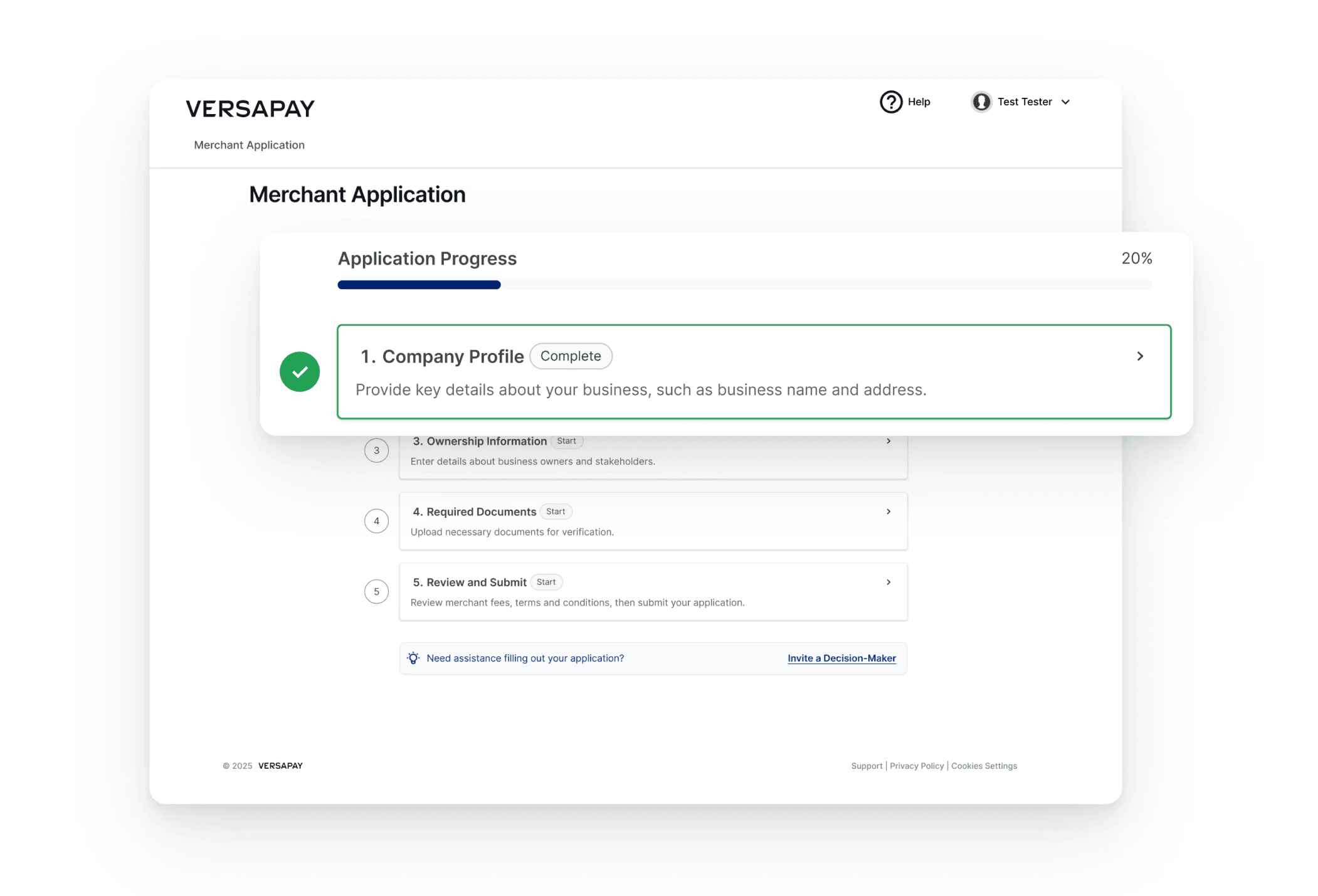

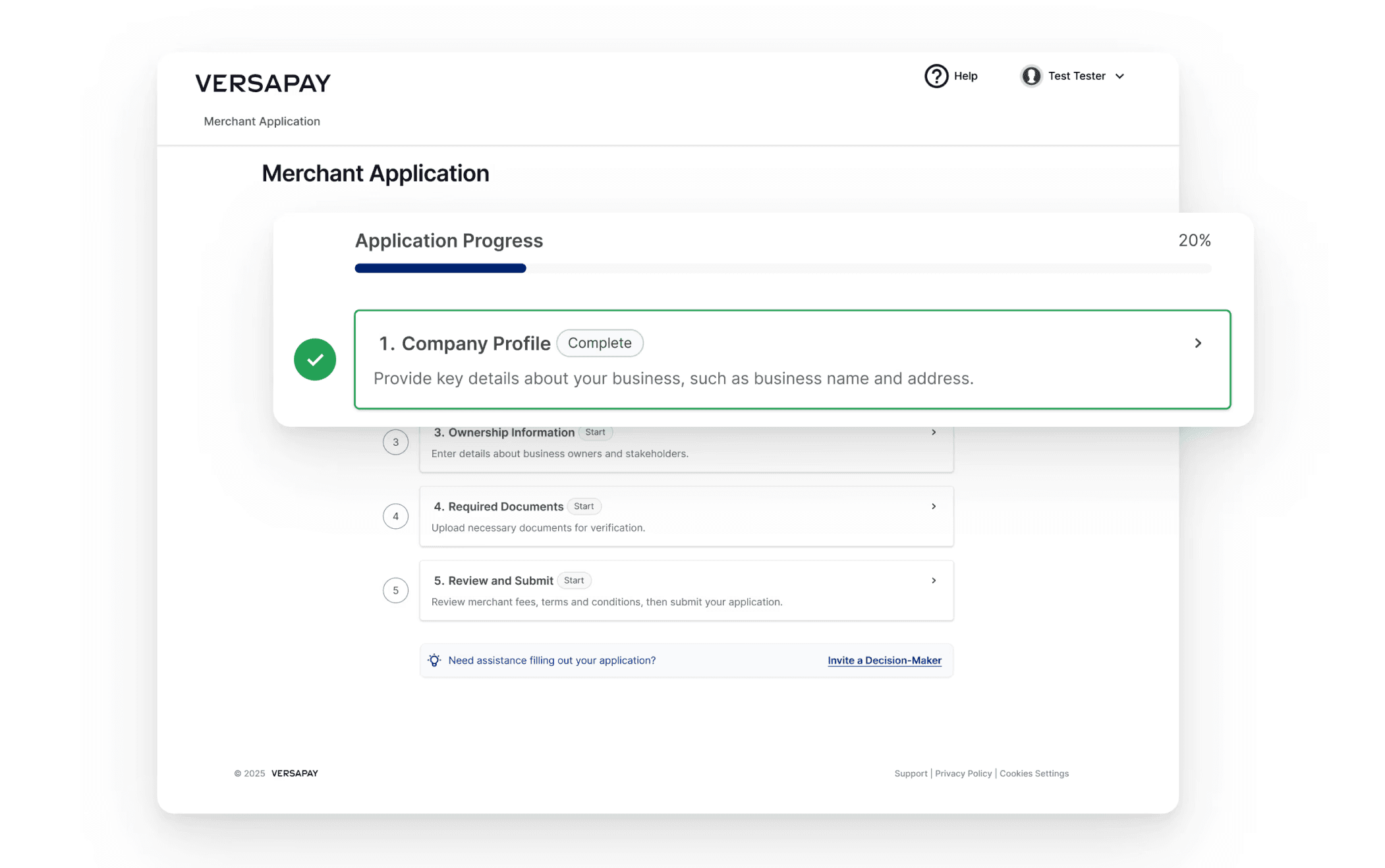

After 👍

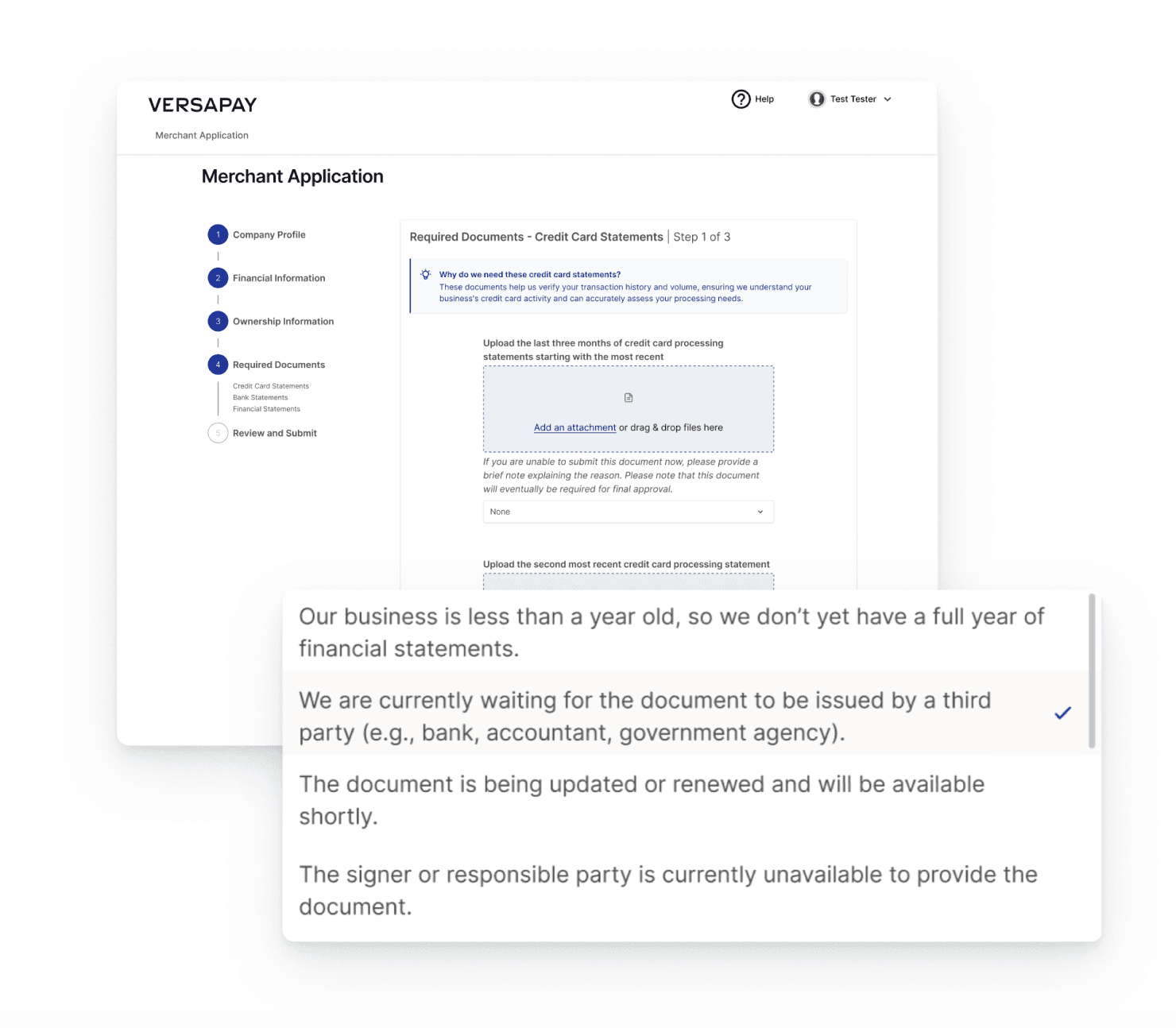

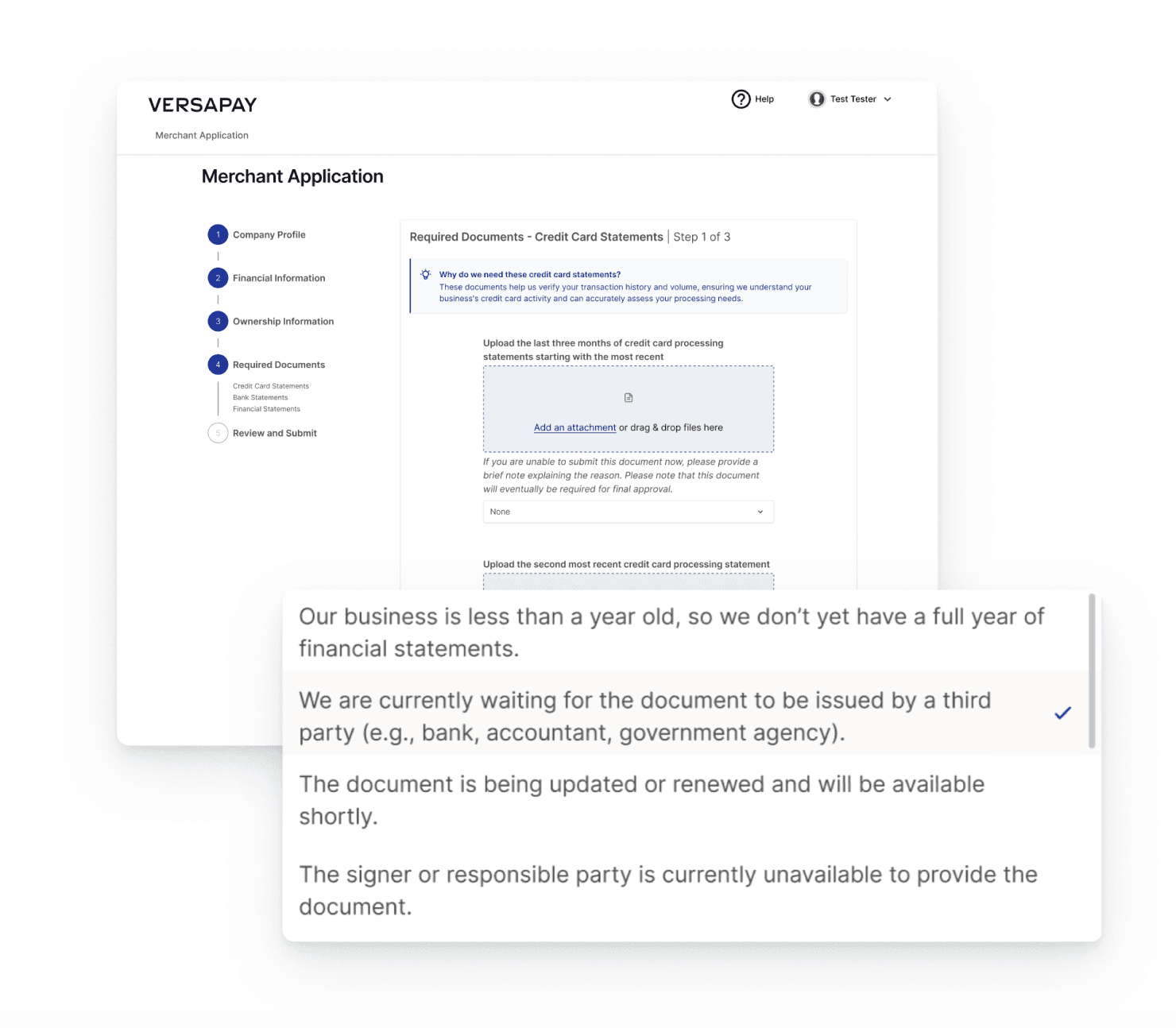

An easy to fill out, 5-step guided flow

Plain-language tooltips, progress indicators, stacked fields for accessibility

Enabled collaborative submissions to make completing the application even easier

Built in flexible document handling and transparent confirmations

After 👍

An easy to fill out, 5-step guided flow

Plain-language tooltips, progress indicators, stacked fields for accessibility

Enabled collaborative submissions to make completing the application even easier

Built in flexible document handling and transparent confirmations

Discovery: Listening Before Designing

Justin G.

Sales Development

Determines the customer fit

Melissa S.

Account Executive

Secures the sale

Isabella F.

Application Specialist

Obtains final sign off

Ashley T.

Underwriting

Evaluates the risk

To ground the work, I led extensive discovery:

Interviews & shadowing with account executives, sales support, underwriting, and other SMEs to uncover what information we truly needed from merchants, and why.

Documentation of underwriter workflows and their verification process, which helped us design the merchant-facing app while simultaneously mapping an internal operations portal.

This ensured the solution worked for both merchants and internal teams.

Discovery: Listening Before Designing

Justin G.

Sales Development

Determines the customer fit

Melissa S.

Account Executive

Secures the sale

Isabella F.

Application Specialist

Obtains final sign off

Ashley T.

Underwriting

Evaluates the risk

To ground the work, I led extensive discovery:

Interviews & shadowing with account executives, sales support, underwriting, and other SMEs to uncover what information we truly needed from merchants, and why.

Documentation of underwriter workflows and their verification process, which helped us design the merchant-facing app while simultaneously mapping an internal operations portal.

This ensured the solution worked for both merchants and internal teams.

My Role: Designing the End-to-End Application

My Role: Designing the End-to-End Application

As the lead product designer, I owned the entire flow, from the initial invitation email through application submission and confirmation.

My goal: build our first independent internal onboarding platform that merchants could complete with confidence, without needing to lean on support.

As the lead product designer, I owned the entire flow, from the initial invitation email through application submission and confirmation.

My goal: build our first independent internal onboarding platform that merchants could complete with confidence, without needing to lean on support.

As the lead product designer, I owned the entire flow, from the initial invitation email through application submission and confirmation.

My goal: build our first independent internal onboarding platform that merchants could complete with confidence, without needing to lean on support.

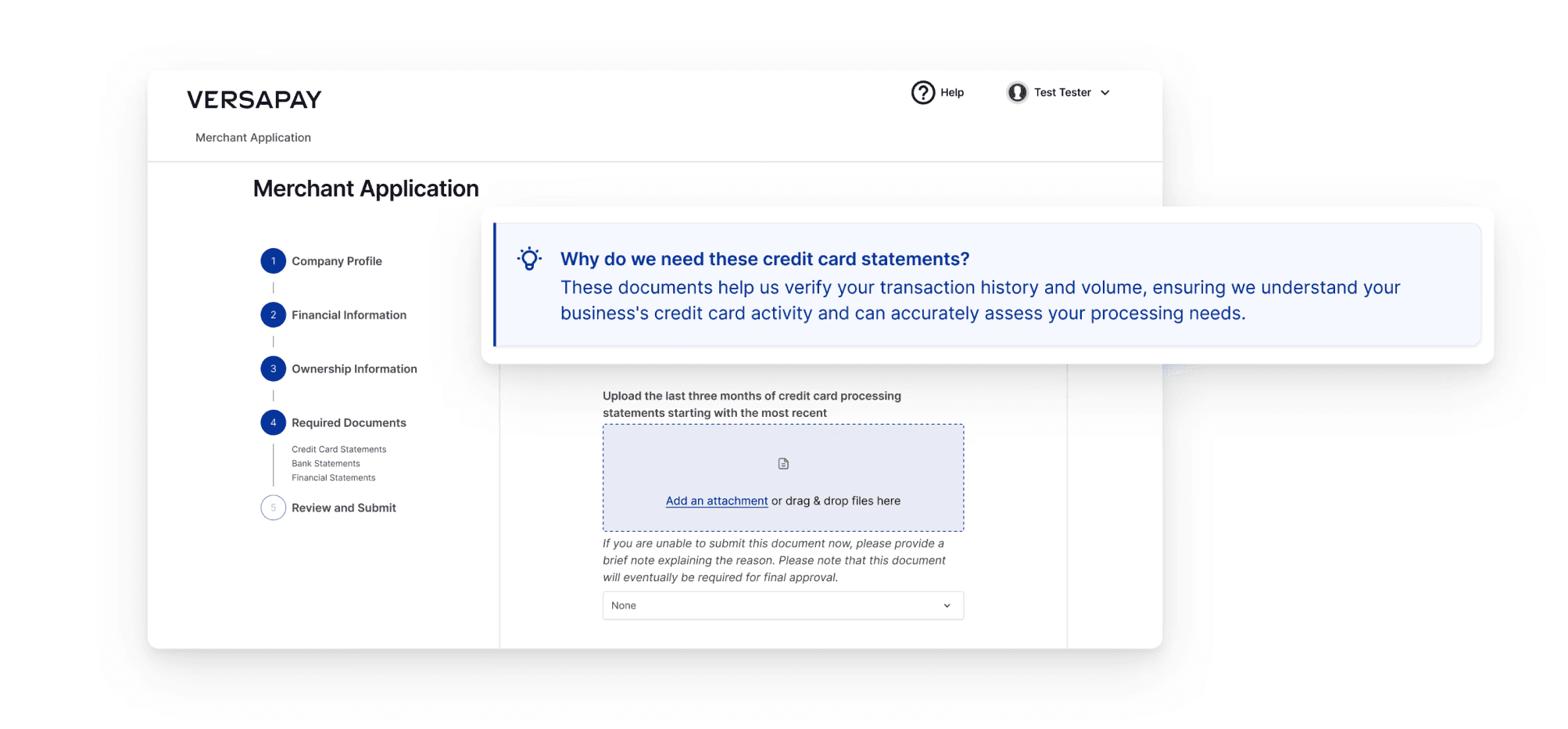

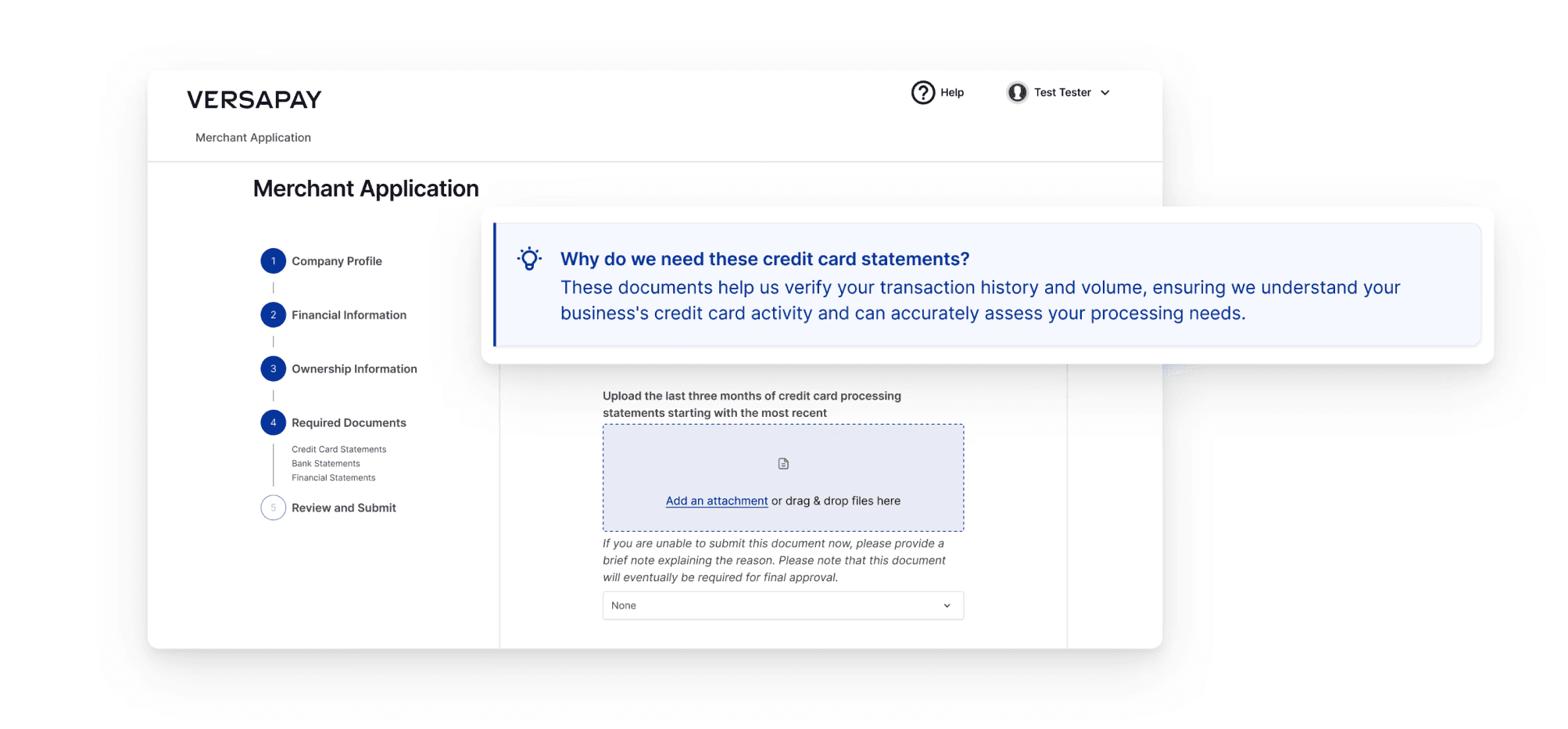

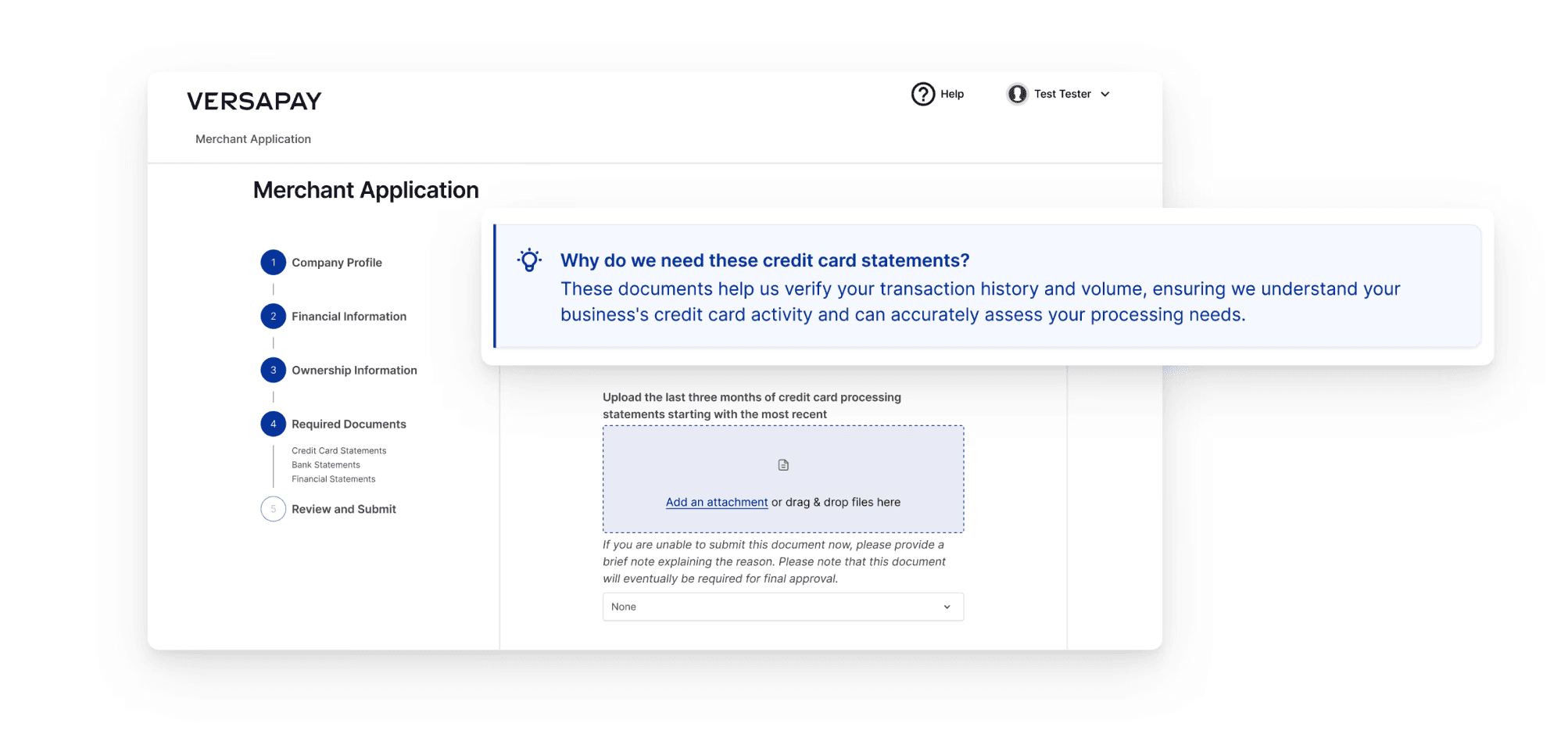

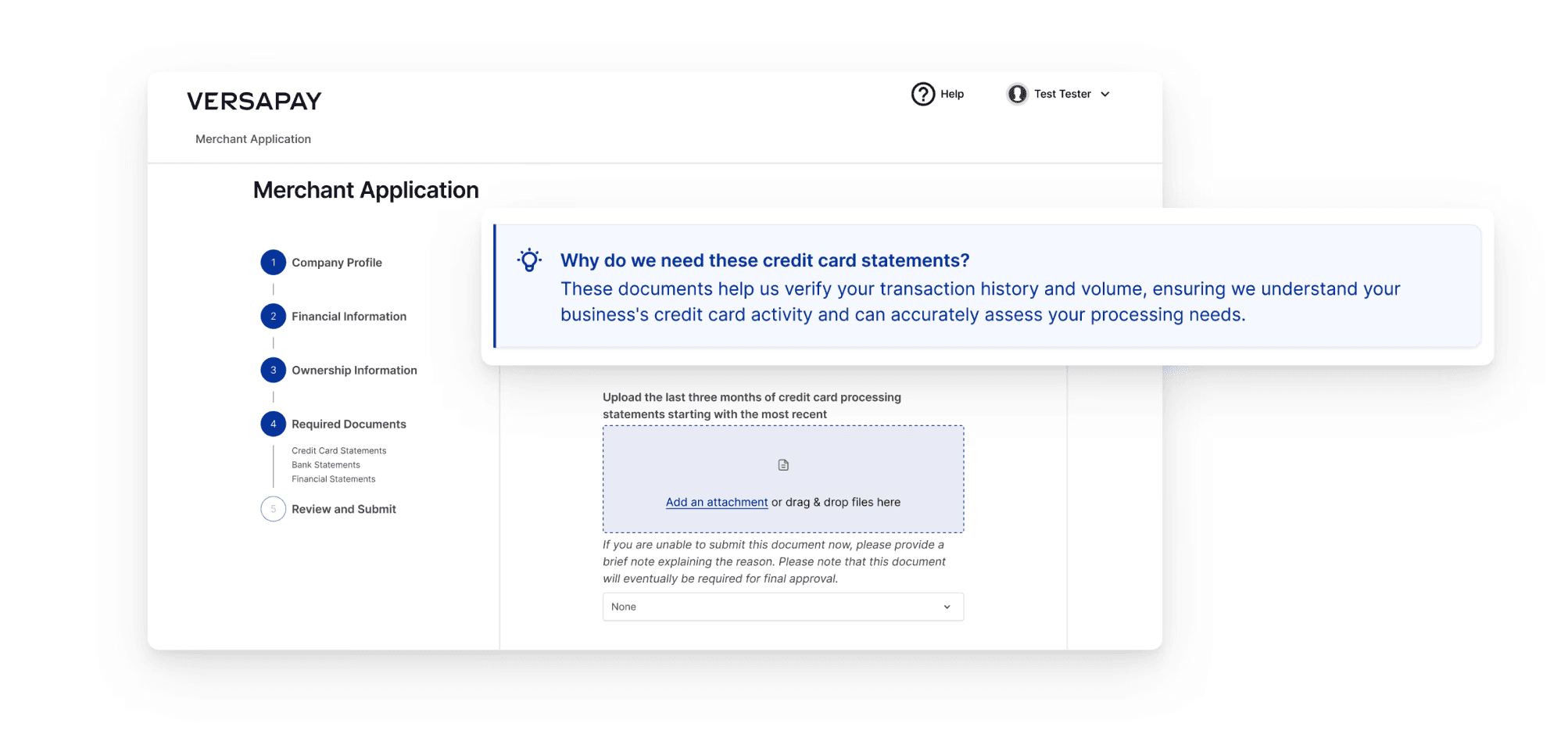

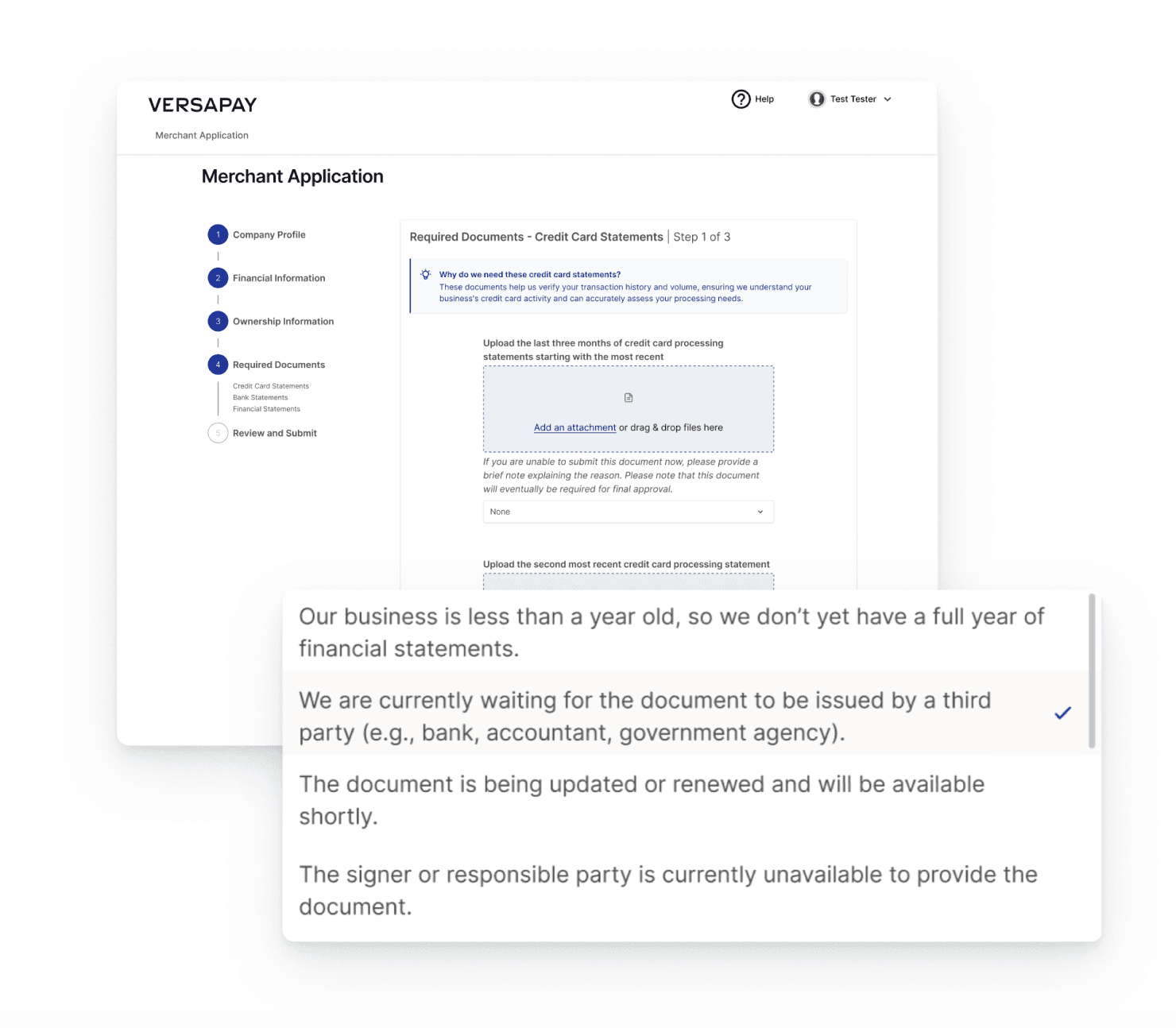

Breaking Down Complexity Into Clarity

Breaking Down Complexity Into Clarity

Instead of overwhelming merchants with an endless form, I designed a 5-section guided process. Each section was short, categorized, and easy to follow, allowing merchants to complete the application in logical, digestible steps.

Instead of overwhelming merchants with an endless form, I designed a 5-section guided process. Each section was short, categorized, and easy to follow, allowing merchants to complete the application in logical, digestible steps.

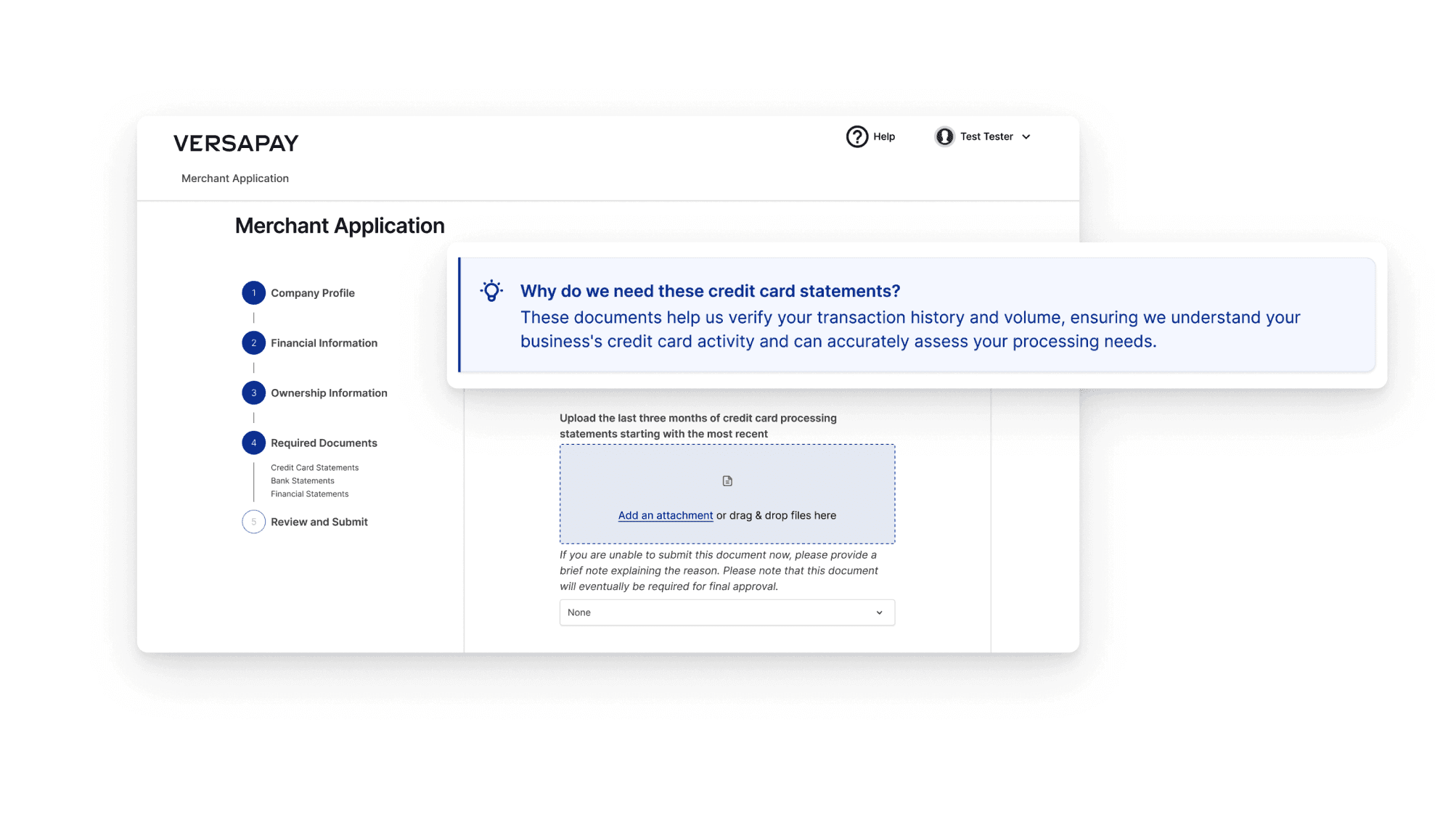

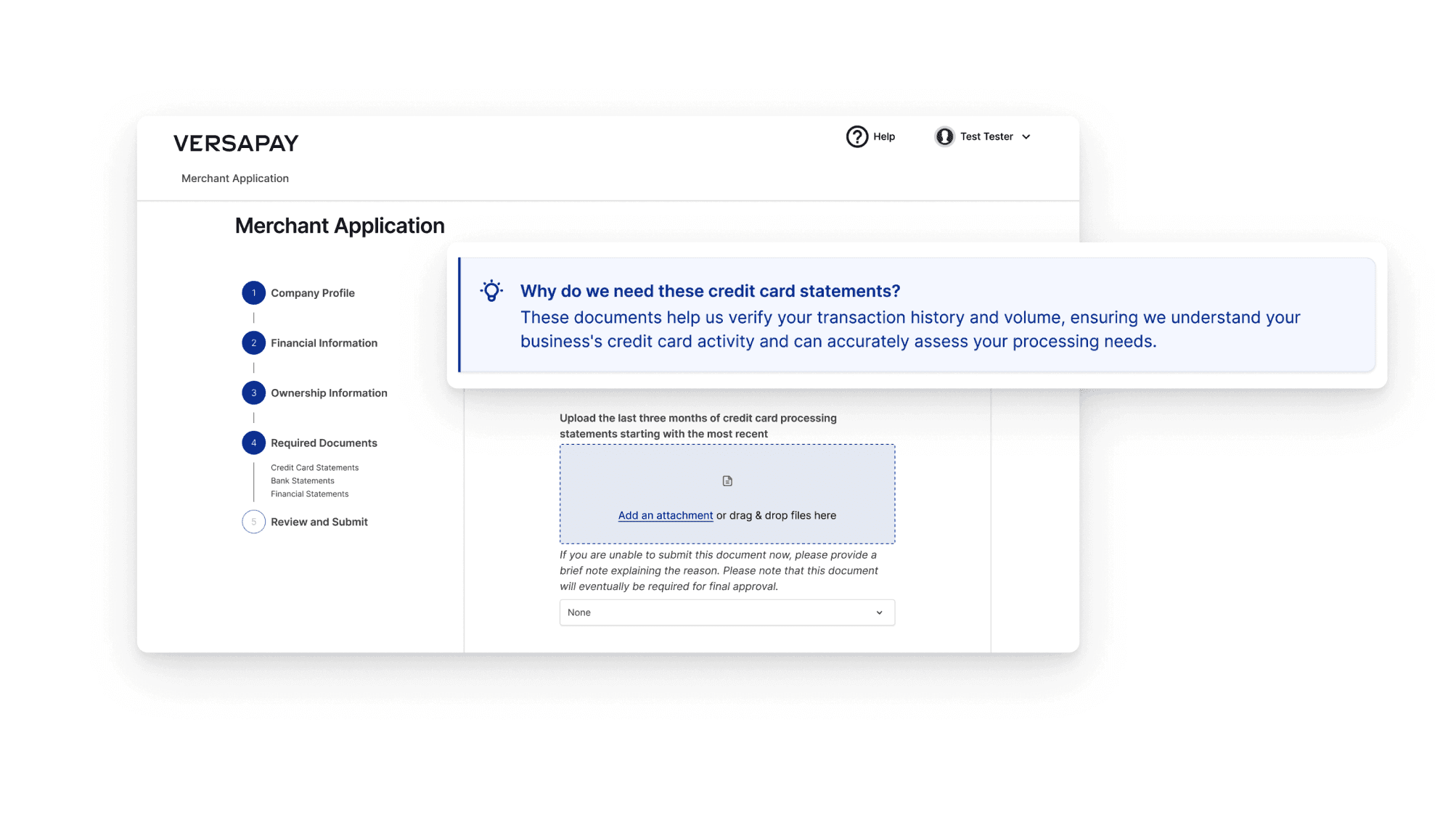

Humanizing the Experience with Transparency

Humanizing the Experience with Transparency

We introduced plain-language tooltips and blurbs above fields (e.g., defining jargon like “NAICS code”) and explaining why we needed specific business details (e.g., Patriot Act fraud prevention). Merchants finally had context, not just fields.

We introduced plain-language tooltips and blurbs above fields (e.g., defining jargon like “NAICS code”) and explaining why we needed specific business details (e.g., Patriot Act fraud prevention). Merchants finally had context, not just fields.

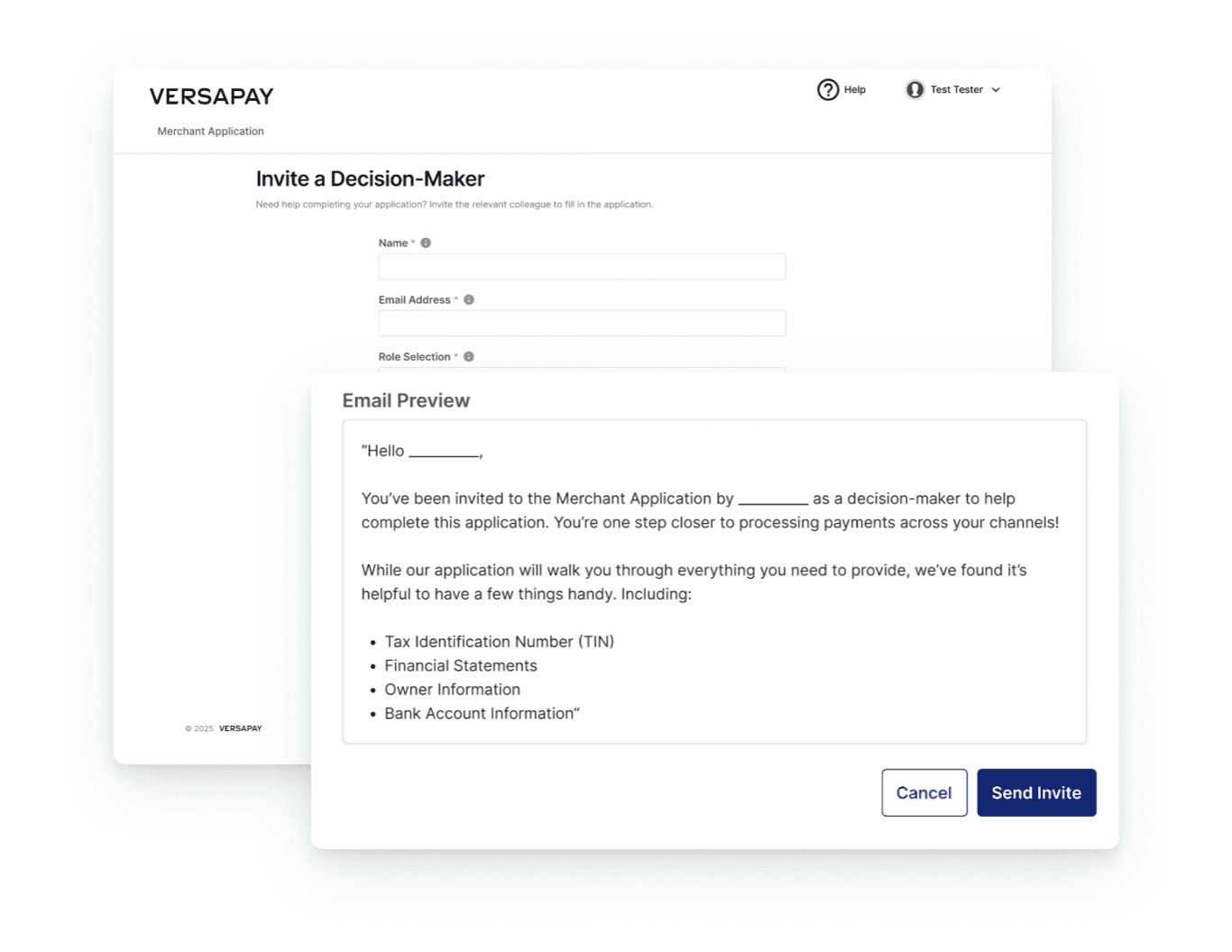

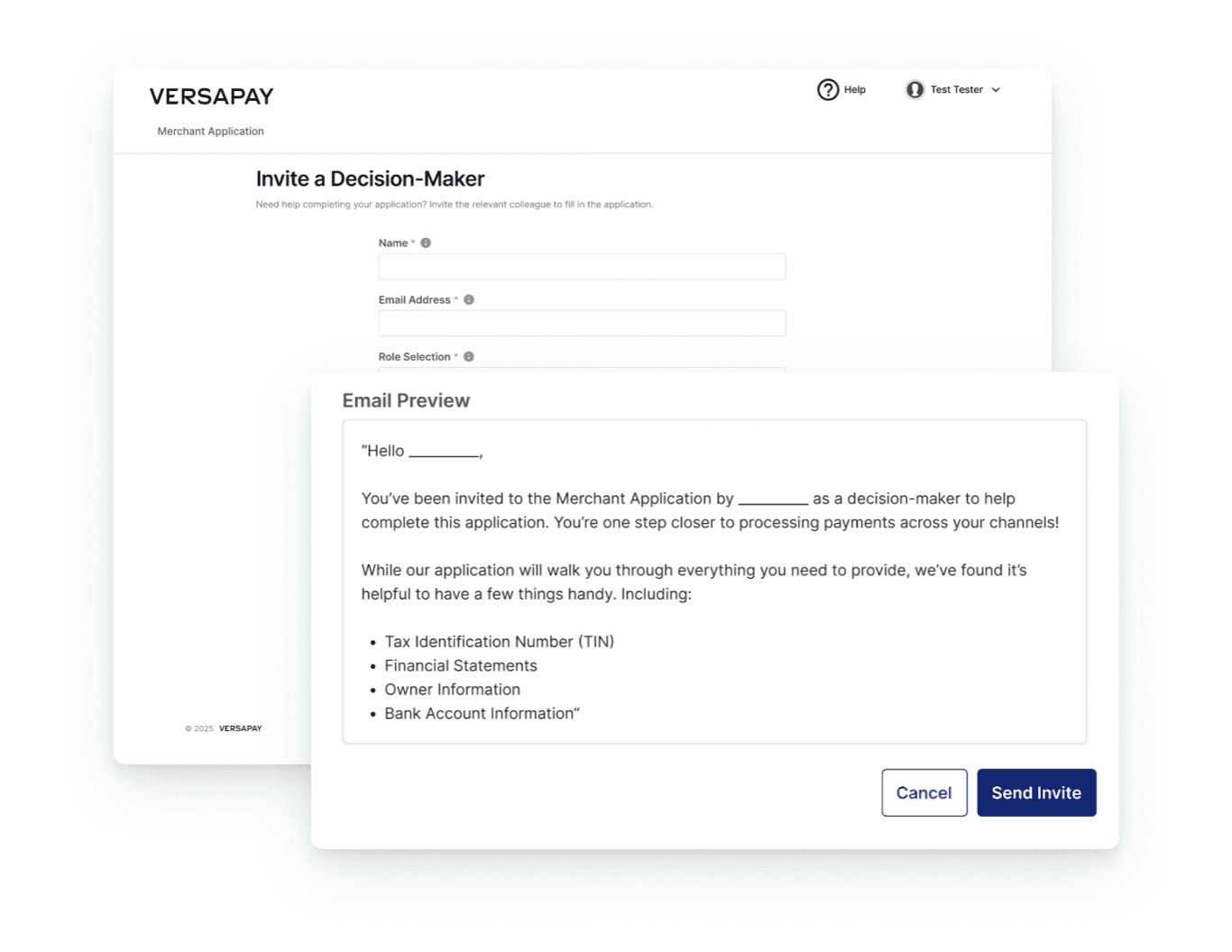

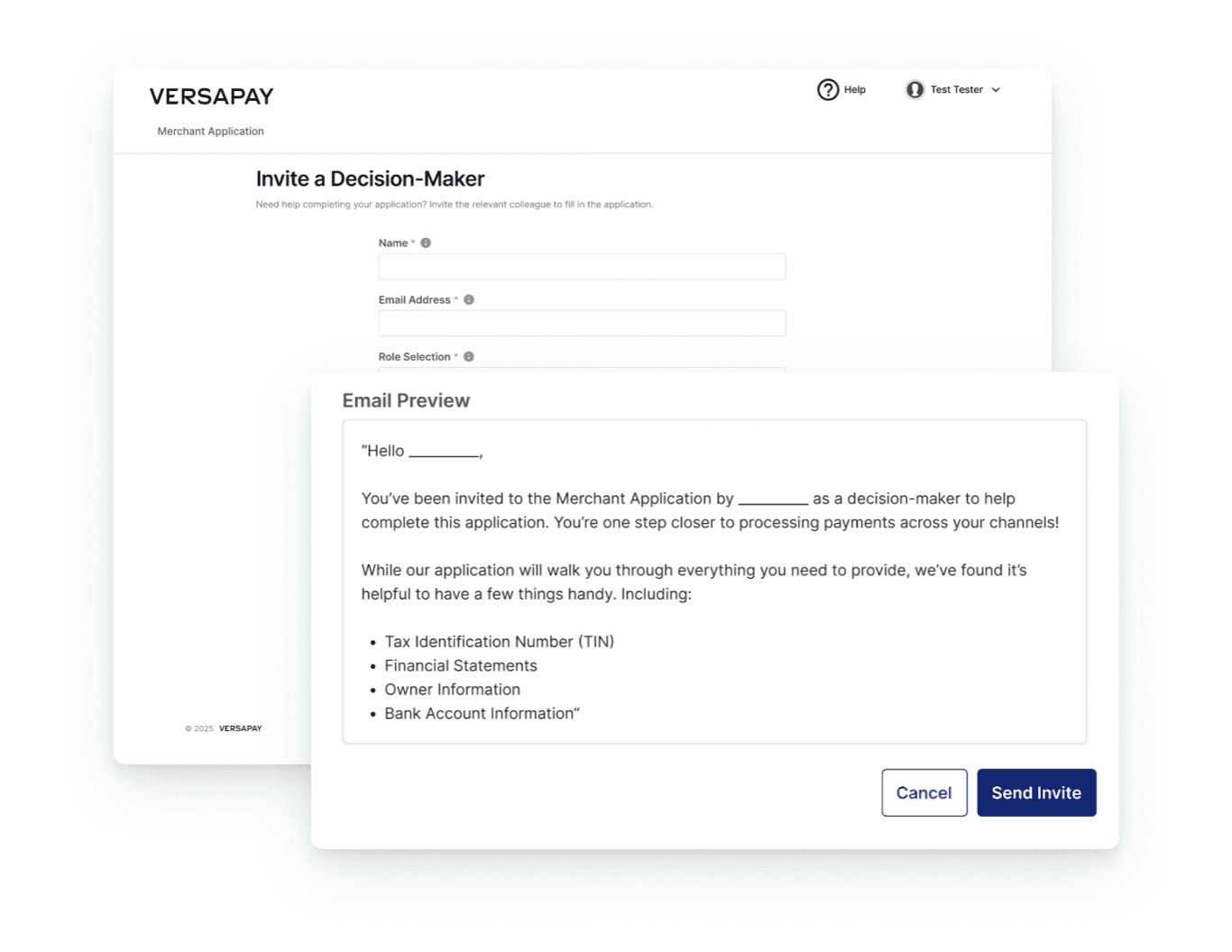

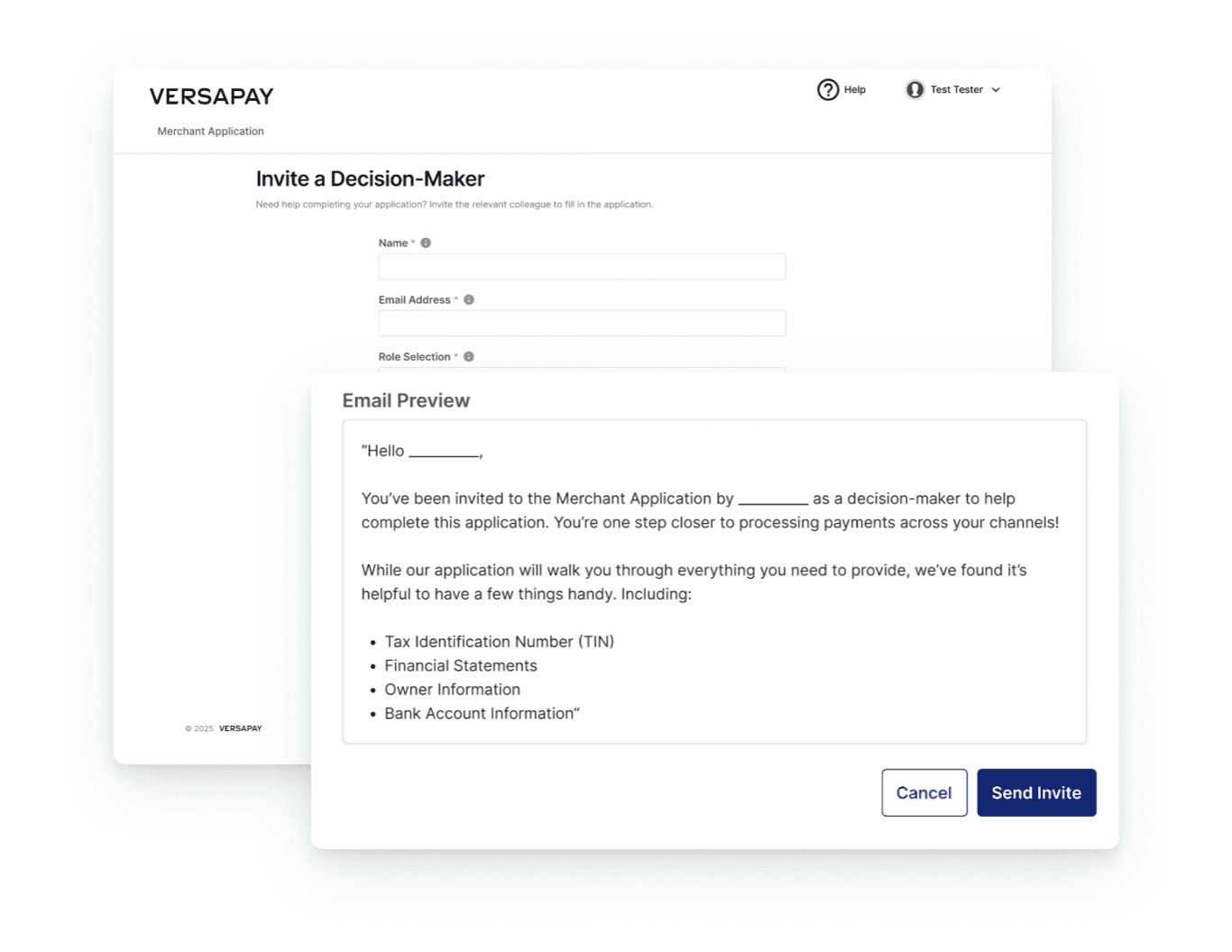

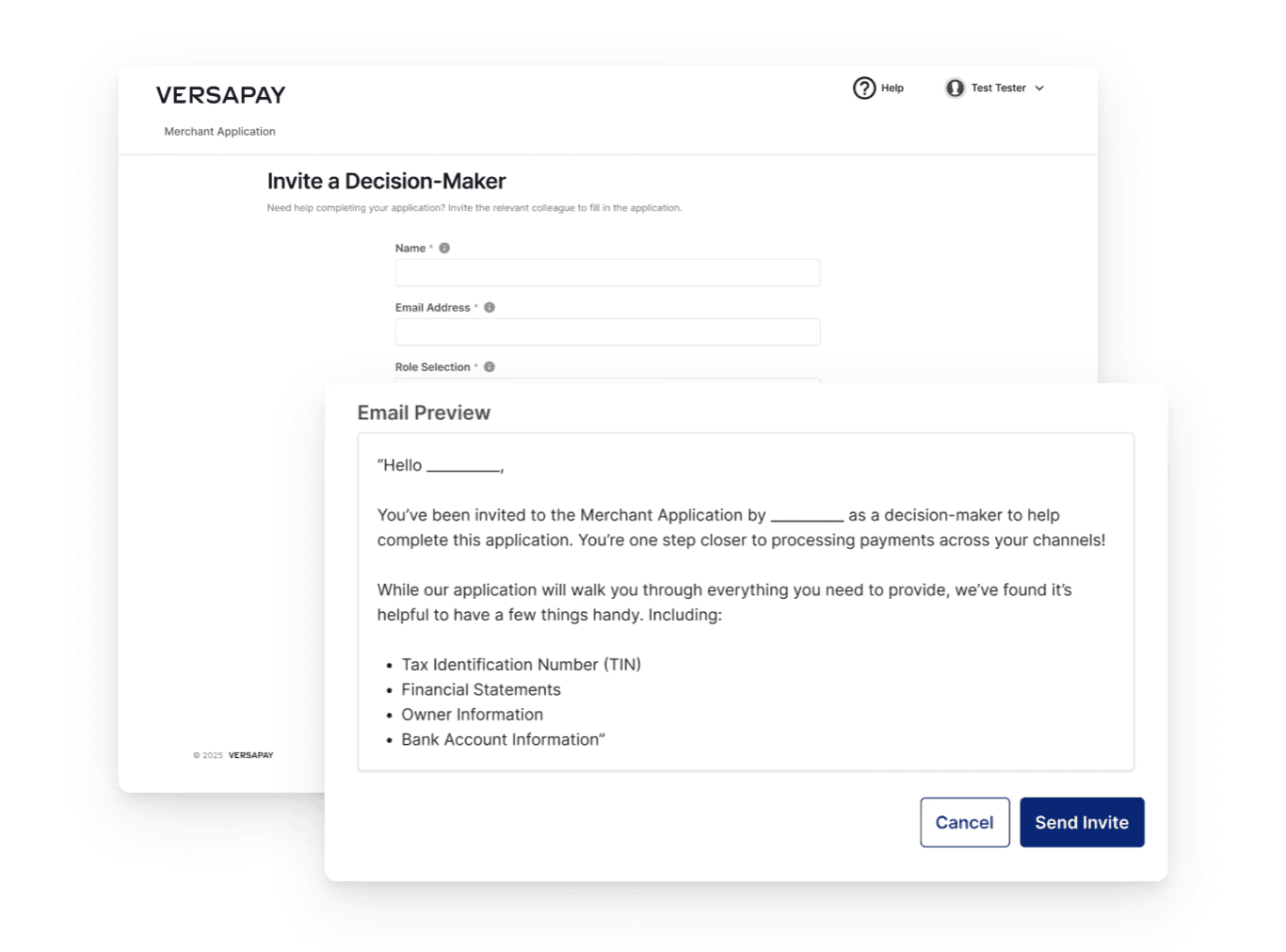

Collaboration, Not Isolation

Collaboration, Not Isolation

Onboarding often requires multiple people. We added the ability for merchants to invite decision makers, like legal or finance colleagues, to upload required documents. This transformed onboarding into a collaborative process, cutting down delays.

Onboarding often requires multiple people. We added the ability for merchants to invite decision makers, like legal or finance colleagues, to upload required documents. This transformed onboarding into a collaborative process, cutting down delays.

Setting Expectations, Building Trust

Setting Expectations, Building Trust

Submission no longer ended in a black box. Merchants received:

Email confirmation

A clear view of next steps

Transparency that underwriting may take 12–24 hours

For the first time, merchants knew what to expect, reducing frustration and support calls.

Submission no longer ended in a black box. Merchants received:

Email confirmation

A clear view of next steps

Transparency that underwriting may take 12–24 hours

For the first time, merchants knew what to expect, reducing frustration and support calls.

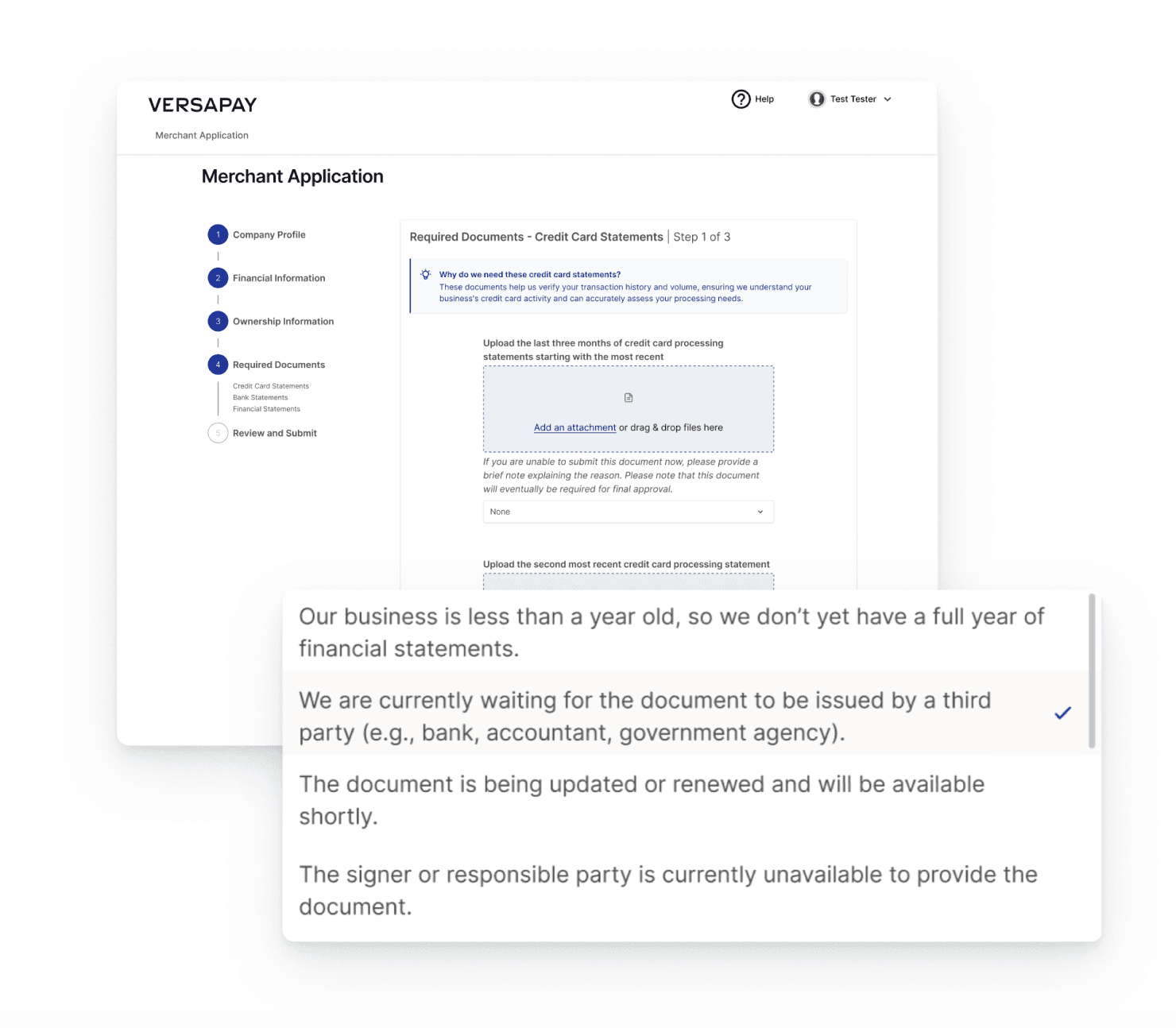

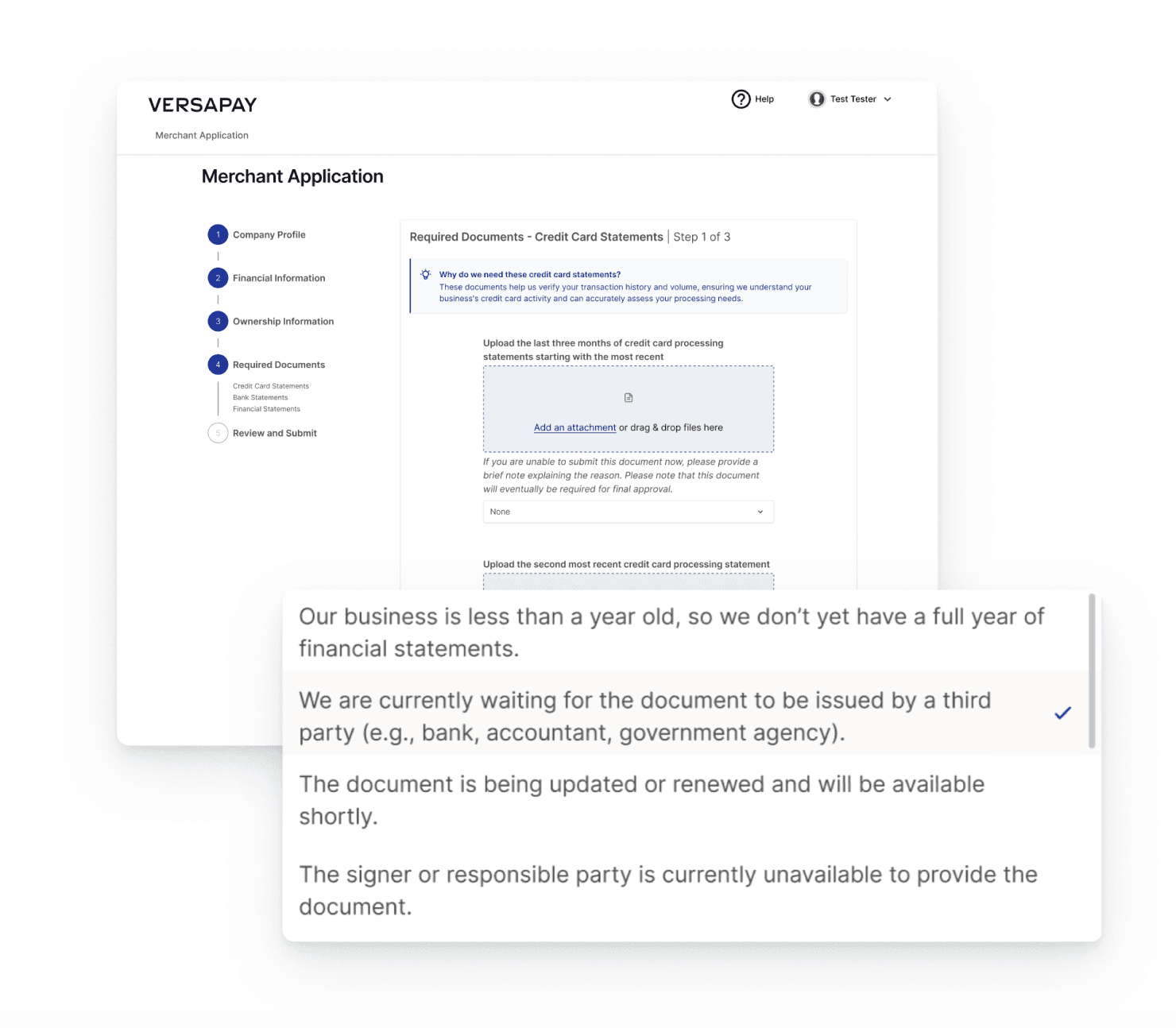

Flexible Document Handling

Flexible Document Handling

If merchants couldn’t upload certain documents right away, the new platform allowed alternate proof of business accounts. No more dead ends, just flexibility and forward motion.

If merchants couldn’t upload certain documents right away, the new platform allowed alternate proof of business accounts. No more dead ends, just flexibility and forward motion.

Validation: Testing Early, Testing Often

Validation: Testing Early, Testing Often

We ran usability testing across two dimensions:

External merchants (5 ICP testers via Usertesting.com): validated flow clarity, ease of use, and information transparency. This testing happened both during ideation and after the first design flow.

Criteria included: working in the finance or accounting department, reviews and reconciles incoming payments, works in a company with over 500 employees.

Justin G.

Sales Development

Determines the customer fit

Melissa S.

Account Executive

Secures the sale

Isabella F.

Application Specialist

Obtains final sign off

Ashley T.

Underwriting

Evaluates the risk

Internal stakeholders: executives, underwriting, and support teams walked through prototypes to ensure internal requirements were met.

This iterative testing cycle helped us identify issues early and quickly refine the design with perspectives across all types of users.

We ran usability testing across two dimensions:

External merchants (5 ICP testers via Usertesting.com): validated flow clarity, ease of use, and information transparency. This testing happened both during ideation and after the first design flow.

Criteria included: working in the finance or accounting department, reviews and reconciles incoming payments, works in a company with over 500 employees.

Justin G.

Sales Development

Determines the customer fit

Melissa S.

Account Executive

Secures the sale

Isabella F.

Application Specialist

Obtains final sign off

Ashley T.

Underwriting

Evaluates the risk

User Tester 1

Operations

User Tester 2

Accounting

User Tester 3

Operations

User Tester 4

IT

User Tester 5

Operations

User Tester 1

Operations

User Tester 2

Accounting

User Tester 3

Operations

User Tester 4

IT

User Tester 5

Operations

Internal stakeholders: executives, underwriting, and support teams walked through prototypes to ensure internal requirements were met.

This iterative testing cycle helped us identify issues early and quickly refine the design with perspectives across all types of users.

Justin G.

Sales Development

Determines the customer fit

Melissa S.

Account Executive

Secures the sale

Isabella F.

Application Specialist

Obtains final sign off

Ashley T.

Underwriting

Evaluates the risk

Building in the Open

Building in the Open

I worked hand-in-hand with engineering:

Raised questions and obstacles in daily standups, and collaborated on phasing work in backlog grooming and sprints.

Shared designs during company-wide engineering demos, creating visibility across the org and surfacing input from subject matter experts who hadn’t been directly involved.

By socializing the work, we avoided surprises and built organizational buy-in.

I worked hand-in-hand with engineering:

Raised questions and obstacles in daily standups, and collaborated on phasing work in backlog grooming and sprints.

Shared designs during company-wide engineering demos, creating visibility across the org and surfacing input from subject matter experts who hadn’t been directly involved.

By socializing the work, we avoided surprises and built organizational buy-in.

The Results: Faster, Easier, More Confident Onboarding

The Results: Faster, Easier, More Confident Onboarding

By transforming a confusing PDF process into a guided, collaborative platform, we created:

A self-serve application merchants could complete independently

Reduced support load through fewer guidance calls

Faster turnaround times for underwriting approvals

Greater merchant trust and confidence in the process

This was the company’s first independent internal onboarding system, setting the stage for scalable, merchant-friendly growth.

By transforming a confusing PDF process into a guided, collaborative platform, we created:

A self-serve application merchants could complete independently

Reduced support load through fewer guidance calls

Faster turnaround times for underwriting approvals

Greater merchant trust and confidence in the process

This was the company’s first independent internal onboarding system, setting the stage for scalable, merchant-friendly growth

Reflection

Reflection

This project highlighted the value of balancing business needs, compliance constraints, and user empathy. Even without modern conveniences like one-line address search, we delivered a frictionless experience by leaning on clarity, accessibility, and transparency.

Iterative testing across merchants and internal teams proved essential, not only to validate usability but also to build organizational trust in design-led problem solving. Most importantly, the measurable 34% reduction in support calls reinforced that thoughtful design directly impacts operational efficiency.

This project highlighted the value of balancing business needs, compliance constraints, and user empathy. Even without modern conveniences like one-line address search, we delivered a frictionless experience by leaning on clarity, accessibility, and transparency. We also intentionally considered deeper analytics: tracking where merchants still drop off, using data to guide iterative refinements.

Iterative testing across merchants and internal teams proved essential, not only to validate usability but also to build organizational trust in design-led problem solving. Most importantly, the measurable 34% reduction in support calls reinforced that thoughtful design directly impacts operational efficiency.

Next Steps

Next Steps

If continued, I’d explore a few more ideas:

Mobile-first workflows - optimizing onboarding for smaller screens, where many merchants first engage.

AI-assisted guidance - predictive help for required documents or auto-filling repetitive business info.

Global expansion - adapting flows for international compliance and different document standards.

Auto-fill most of your application - connecting your account with another financial partner (visual below).

If continued, I’d explore a few more ideas:

Mobile-first workflows - optimizing onboarding for smaller screens, where many merchants first engage.

AI-assisted guidance - predictive help for required documents or auto-filling repetitive business info.

Global expansion - adapting flows for international compliance and different document standards.

Auto-fill most of your application - connecting your account with another financial partner.

© Jimin Ngo 2026